Legora and Harrison LLP Announce Partnership to Bring Cutting-Edge AI to Private Wealth Law Clients

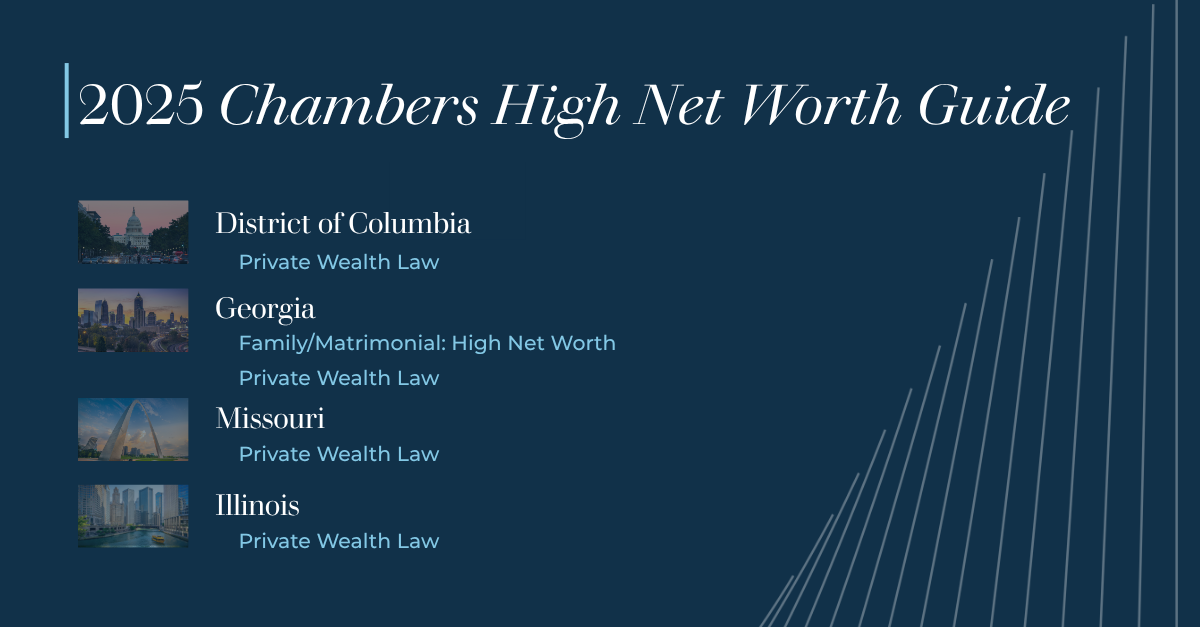

Legora, a leading legal AI platform, today announced a strategic partnership with Harrison LLP, a national private wealth planning law firm. This collaboration will empower their lawyers to focus on their highest-value work: advising clients on complex challenges.