Our People

.png)

Keith Herman

- T 636.246.0010

- F 314.802.4077

Keith Herman

Partner | St. Louis, MO

Keith focuses his practice on guiding families through generational wealth and well-being planning.

.png)

- T 636.246.0010

- F 314.802.4077

Disclaimer

By sending this email, you acknowledge that you will not become a client of Harrison LLP merely by sending this email or by the Firm's receipt of it.

Keith focuses his practice on guiding families through generational wealth and well-being planning.

As many of Keith’s high-net-worth clients have closely held businesses and private foundations, he often provides advice on matters relating to these entities, including the transition of a business to the next generation. Keith works with many multigenerational families to preserve their wealth and educate younger family members, including representing family offices.

Keith represents individual and corporate trustees with respect to all aspects of their fiduciary duties and the trust administration process, including trust litigation. He also represents individuals on their rights as beneficiaries of trusts. Keith routinely handles gift and estate tax audits.

In addition to being an elected fellow of the American College of Trust and Estate Counsel, Keith is a former adjunct professor at the Washington University School of Law, teaching Family Wealth Management I and Family Wealth Management II. He is also certified as a Trust and Estate Practitioner (TEP) by the Society of Trust and Estate Practitioners, an international organization for attorneys and other advisors who focus on family inheritance and succession planning.

Capabilities

Charitable Planned Giving

Estate Planning

Estate & Trust Administration

Family Business Advice

Prenuptial & Postnuptial Agreements

Tax Planning

Speeches & Publications

“Setting Every Community Up for Retirement Enhancement Act of 2019,” NAIFA, Des Peres Lodge, November 19, 2019

“Recent Developments with Asset Protection,” Greensfelder’s Annual Estate Planning Symposium, St. Louis, MO, November 7, 2019

“Upstream Basis Planning,” Annual Greater St. Louis Financial Symposium, St. Louis, Missouri, April 25, 2019

“Best Planning Ideas for 2018,” Greensfelder’s 2018 Estate Planning Symposium, St. Louis, MO, November 1, 2018

“The New Tax Act,” Greensfelder Estate Planning Seminar, Missouri Athletic Club West, St. Louis, Missouri, May 9, 2018 “Income Tax Planning Is The New Estate Tax Planning” BAMSL 29th Annual Trust & Estate Planning Institute, May 3, 2018

“Income Tax Planning Is The New Estate Tax Planning,” Greater St. Louis Financial Symposium, hosted by: The FPA of Greater St. Louis, NAIFA St. Louis and Society of Financial Service Professionals Greater St. Louis, April 26, 2018

"Practical Strategies To Save Income Taxes,” 2017 Greensfelder Estate Planning Symposium, November 2, 2017

“Potpourri of Income Tax Planning Ideas, Including State Trust Income Tax Planning and ING Trust,” ACTEC 2017 Heart of America Meeting, Bentonville, Arkansas, April 21-23, 2017

Making the Most of Your Year-End Gifting Greensfelder Estate Planning Seminar, November 3, 2016

“Current Developments in Estate Planning,” American Red Cross Professional Advisors Seminar, May 18, 2016

“Retirement Account Beneficiaries — An Update,” 2015 Greensfelder Estate Planning Seminar, November 19, 2015

“Recent Developments in Estate Planning for Retirement Assets,” Missouri Bar Annual Estate & Trust Institute, September 2015

“How to protect assets from a beneficiary’s divorce,” 25th Annual Estate Planning Institute, April 23, 2014

“Naming Trusts as Beneficiaries of Retirement Plans, 2014 Tax Update,” Bar Association of Metropolitan St. Louis, January 2014

“Recent Developments in Retirement Benefit Planning,” Missouri Bar Annual Estate & Trust Institute, October 2013

“Advising Individual Trustees: A Review of the Powers, Duties, and Risks of Serving as Trustee,” American College of Trust and Estate Counsel 2012 Mo-Kan Meeting, Kansas City, MO, December 8, 2012

“Estate Planning for Retirement Assets: Taxation and Other Challenges,” Strafford Webinars and Teleconferences, November 1, 2011

“Estate Planning Tools For Retirement Plans,” NBI Teleconference, August 18, 2011

“Coordinating Retirement Accounts With Estate Planning,” University of Missouri-Kansas City Estate Planning Internship Program, October 22, 2010

“Protecting Trust Assets From a Beneficiary’s Divorce,” University of Missouri – Kansas City Estate Planning Internship Program, October 22, 2010

“Current Issues in Estate Planning for Retirement Benefits,” MoBar Annual Estate & Trust Institute, September 2010

“Coordinating Retirement Planning With Estate Planning,” MOKAN, Midwest Trust and Financial Services Conference, Overland Park, KS, May 5-7, 2010

“Asset Protection Planning with Trusts,” Bar Association of Metropolitan St. Louis 20th Annual Estate Planning Institute, April 23, 2009

“Estate Planning for Retirement Benefits,” Missouri Bar Annual Estate & Trust Institute, September-October 2008

“Protecting Trust Assets From a Beneficiary’s Divorce,” Bar Association of Metropolitan St. Louis 19th Estate Planning Annual Institute, April 24, 2008

“Coordinating Retirement Plans and Estate Planning,” Missouri Bar/Missouri Judicial Conference Annual Meeting, September 27, 2007

“Asset Protection Planning With Trusts,” AG Edwards Trust and Estates Forum, June 15, 2007

“Planning For Charitable and Other Distributions From IRAs and Qualified Plans,” Red Cross Charitable Legislative Update, May 3, 2007

“Asset Protection Planning With Trusts Under The Missouri Uniform Trust Code and 2006 Technical Amendments,” Bar Association of Metropolitan St. Louis 8th Annual Estate Planning Institute, April 26, 2007

“Planning For Distribution From IRAs and Retirement Plans,” Missouri Bar Annual Estate & Trust Institute, September-October 2006

“An Attorney’s Guide to Asset Protection,” National Business Institute, September 12, 2006

“Asset Protection for the Estate Planner,” Bar Association of Metropolitan St. Louis, November 1, 2005

Publications

“Protecting Retirement Assets from Creditors,” Journal of the Missouri Bar, July/August 2019

“Missouri Asset Protection Trust,” Bogert’s The Law of Trusts and Trustees, Thomson Reuters, 2017

“How to Draft Trusts to Own Retirement Benefits,” The American College of Trust and Estate Counsel Law Journal, Winter 2014

“Modifying Irrevocable Trusts,” St. Louis Business Journal, October 2012

“Using Life Insurance For Asset Protection – What is Really Protected?,” Journal of the Missouri Bar, January/February 2012

“How To Protect Trust Assets From A Beneficiary’s Divorce,” Journal of the Missouri Bar, September/October 2007

“Coordinating Retirement Accounts with Estate Planning,” The Advanced Underwriting Service, January 2007

“Coordinating Retirement Accounts With Estate Planning 101,” GP Solo, American Bar Association, Vol. 23, No. 6, September 2006

“Asset Protection Under the New Missouri Uniform Trust Code,” Journal of The Missouri Bar, pp. 196-204, July/August 2006

“Coordinating Retirement Accounts With Estate Planning 101 (What Every Estate Planner Needs To Know),” Probate & Property, Vol. 20 No. 1 edition, page 52, January/February 2006

“Creditor Protection Issues Arising With Missouri Trusts,” Bar Association of Metropolitan St. Louis, Asset Protection for the Estate Planner, Fall 2005

“Reasons to Complete an Estate Plan,” St. Louis Lawyer, May 2004

“Fixing Irrevocable Trust Problems,” The St. Louis Bar Journal, Fall 2003 “Fixing Irrevocable Trust Problems” The St. Louis Bar Journal, Fall 2003

Admissions

Missouri

Illinois

Education

University of Missouri School of Law, J.D., Missouri Law Review

University of Missouri – Columbia, B.S.

Awards & Honors

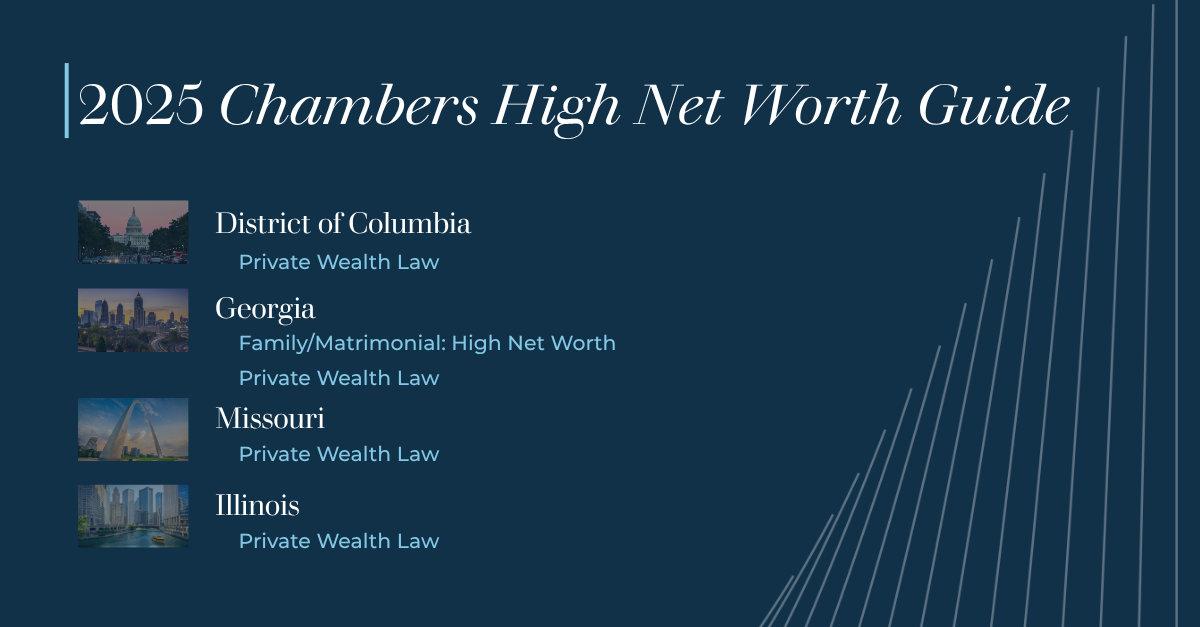

Chambers High Net Worth Guide, Private Wealth Law (2019-present)

The Best Lawyers in America®, Closely Held Companies and Family Business Law (2023-present); Trusts and Estates (2018-present); St. Louis area Trusts and Estates Lawyer of the Year (2023)

St. Louis Magazine, Best Lawyers in St. Louis (November 2018)

St. Louis Magazine, Top Accounting & Estate Planning Professionals in St. Louis for Exceptional Service & Overall Satisfaction (March 2014)

Probate & Property, Excellence in Writing Award, Best Overall Article – Probate & Trust, “Coordinating Retirement Accounts with Estate Planning 101 (What Every Estate Planner Needs to Know)” (2006)

Organizations

American Bar Association, Real Property, Probate & Trust Law Section

American College of Trust and Estate Counsel, Fellow

Missouri Bar Association, Probate & Trust Law Committee

Bar Association of Metropolitan St. Louis

Estate Planning Council of St. Louis

Related News & Insights

.png)

Harrison LLP Relocates to Expanded Frontenac Office to Support Continued Growth in St. Louis Market

.png)

30 Harrison Attorneys Recognized by Best Lawyers®