National in scope.

Local in practice.

Built on trust.

We assist clients in defining and achieving their private wealth goals, delivering peace of mind through sophisticated and practical legal counsel.

A National Private Wealth Planning Law Firm

Offices nationwide, allowing for unmatched collaboration to meet client needs.

Private wealth law attorneys highly experienced in advanced strategies for wealth preservation.

ACTEC Fellows committed to maintaining excellence in the trusts and estates legal field.

Ranked five years in a row for Private Wealth Law and across five markets

15 Fellows who are leading members of the Trust & Estates profession and have made substantial contributions to the field

.png?width=1200&length=1200&name=Best%20Law%20Firms%20(2).png)

Who We Are

Our Capabilities

Our services extend to the natural interplay between wealth planning and clients’ other personal and business needs.

Estate Planning and

Trust Administration

Domestic and Cross-Border

Trust & Estate Litigation | Tax Controversies

Charitable Guidance

Family Law

Family & Closely Held Business Advice

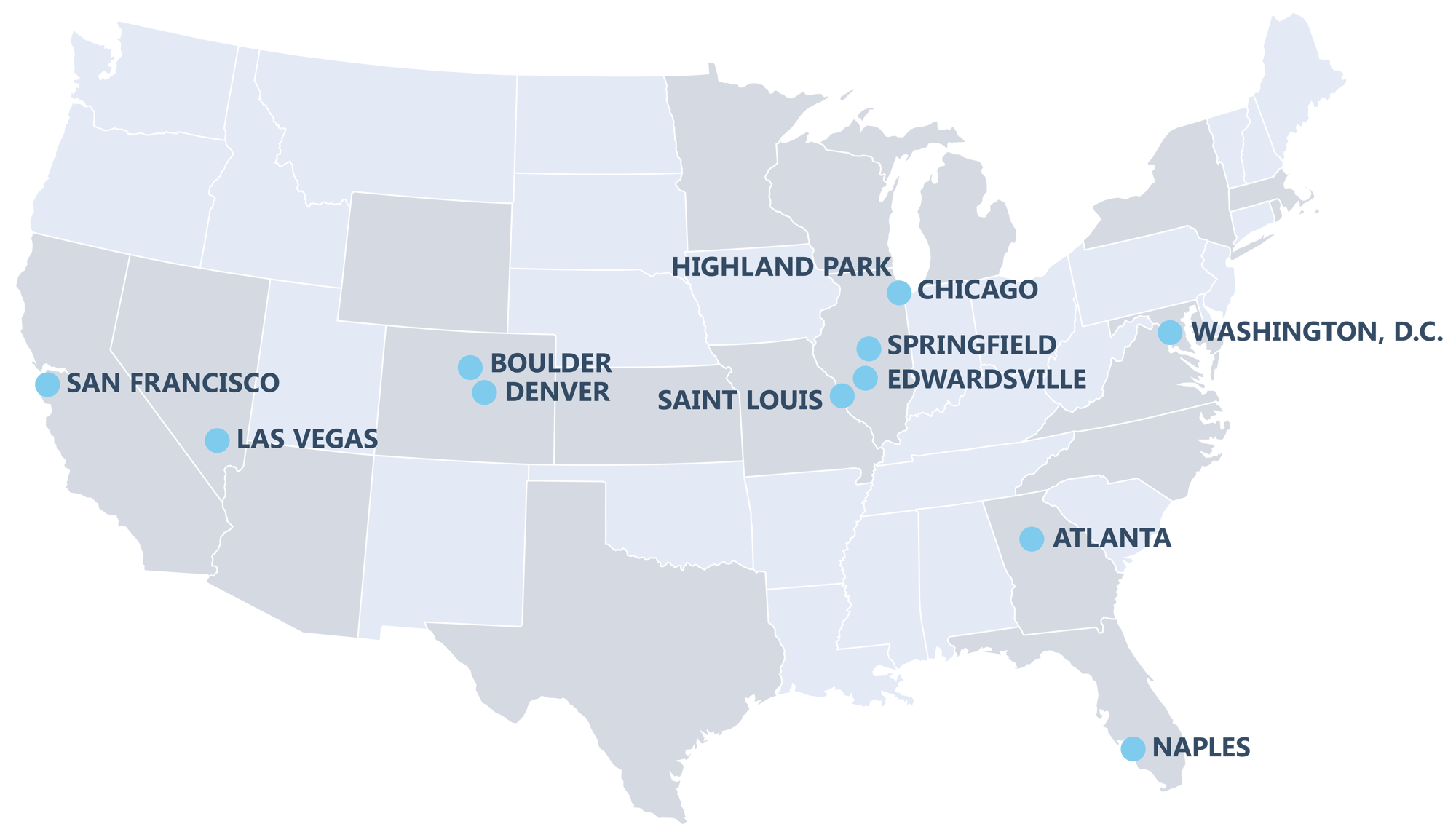

Our National Reach

Unmatched collaboration to meet client needs and provide advanced strategies for wealth preservation.

![]()

Our People

Our private wealth law capabilities stand out through the exceptional depth of our team's talent with expertise in gift and estate planning; trust, estate, and tax controversies; charitable guidance; family law; and family business advice.